Then Year refers to obligations (or dollars which will be spent over time). Current Year refers to expenditures (a transaction at "time now").

Obligations: "Binding agreement that will result in outlays immediately or in the future."(DOD 7000.14 - R Vol. 2, 1-14)

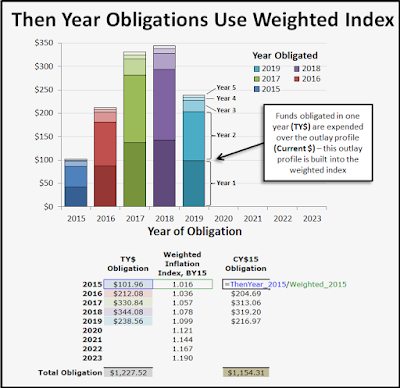

The government may obligate $100M to a contractor in 2015, but it is often the case that the contractor will expend those dollars over the next several years according to an outlay profile. Because the purchasing power of the dollar will (usually) decrease over time, this $100M obligation must already account for expected inflation. We therefore need to use a weighted index, which is merely a normal "raw" index that accounts for expenditure time-phasing by "building in" the outlay profile. Notice that the base year of the weighted index is greater than 1.000 because it is a composite of value over several years.

|

| Cost Estimator's Corner: TY Obligations Use Weighted Index |

Outlays: "The amount of checks issued or other payments made (including advances to others), net of refunds and reimbursements collected. The terms “expenditure” and “net disbursement” are frequently used interchangeably with the term “outlay.” (DOD 7000.14 - R Vol. 2, 1-14)

This expenditures scenario is most people are used to. I spent a dollar in 2010, so I apply the raw (unweighted) index value from 2010. I did not obligate a dollar to the grocery store in 2010 and acquire goods over the next several years. I just apply the raw index value from 2010 to that cost to receive it in a Constant Year (CY).

If there are expenditures over a number of years, the sum of expenditures in each year must have the appropriate raw index value from the matching year applied.

|

| Cost Estimator's Corner: Current Year Expenditures Use Raw Index |

Update:

How does a Then year dollar go from Appropriation to Obligation to Expenditure?

No comments:

Post a Comment