"A pharmaceutical company develops a new cancer drug. A Hollywood studio creates a box-office blockbuster. A song writer records a new hit. On July 31, BEA will begin including the amount of money businesses invest in the production of such intellectual property as part of gross domestic product (GDP).

Why?

The changes reflect updated international guidelines for national economic accounting—the United Nations’ System of National Accounts 2008 (SNA). It’s important that economic measures keep pace with a changing global economy and that GDP statistics from different countries use a common set of guidelines for comparability.

Australia and Canada already implemented some of the changes outlined in the 2008 SNA. The United States is taking steps later this month. Europe is expected to act next year.

Expenditures for research and development (R&D) and for entertainment, literary, and artistic originals have many of the characteristics of other fixed assets—ownership rights can be established, the assets are long-lasting, and they are used repeatedly in the production process. Thus, the SNA recommends that expenditures on the production of these types of intangible assets, or intellectual property, be treated as fixed investment. That’s consistent with the way we treat the production of tangible assets like a new drill press in a factory.

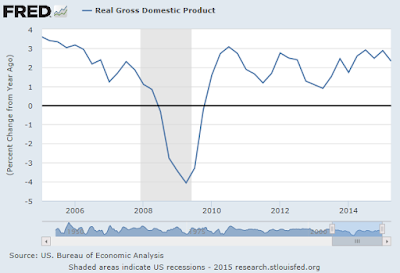

|

| Annual % Change in Real GDP - St. Louis Fed |

BEA will also improve the way we count defined benefit pension plans in the GDP accounts.

Unlike defined contribution plans like 401(k)s, defined benefit pension plans provide a benefit to employees based on factors such as length of service and salary history.

Employers provide these promised benefits to employees through a pension fund. Employers, and in some cases employees, make cash contributions to the fund. In addition, the fund holds financial assets, earns income and capital gains on those assets, and pays out benefits to retirees and beneficiaries.

On July 31, we will switch from a cash accounting method to an accrual accounting method to measure the transactions of defined benefit pension plans. That means we will count the benefits as employees earn them, rather than when employers actually make cash payments to pension plans."

That was from the BEA's Blog.

The expanded R&D coverage will increase the dollar level of GDP and the effect of the switch to accrual accounting for pensions is to primarily dampen measurement volatility.

Though we often think that "the numbers don't lie," the complexity -- and art -- of measuring economic activity means that their interpretations are not so clear. The Fed needs others to perceive it to be data-driven to give the appearance of policy rules. I wonder if actual decisions are made in the way that their public guidance implies -- that everything hinges on the next data point. Probably not in practice...

Bloomberg ran a poll where 50% of respondents believed the first rate hike will be in September and only 10% believed it would come in 2016 (there was no answer for "post-2016"). Institutional investors are even more confident in September.

I'm one of those people who would guess the rate hike comes in 2016. But would I be willing to put my money where my mouth is and buy equities or sell bonds before an announcement? Nah. I think by now it's clear, however, that the Fed's current mechanism of forward guidance doesn't do a great job of coordinating expectations. I would like Janet Yellen to articulate her overall judgement more clearly instead of pitter-pattering around "it depends on the data...."

No comments:

Post a Comment