"Mark Carney predicted a bout of 'muted' inflation in the U.K. after all but one of the Bank of England’s policy makers decided that price pressures are too weak to raise interest rates for now.

|

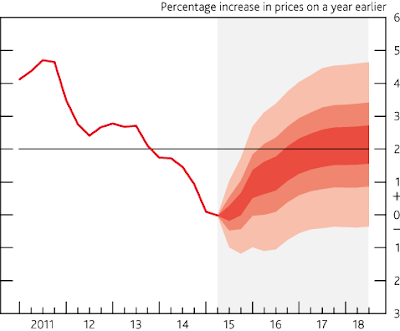

| UK Inflation is Well Under Target and Falling |

The BOE governor, presenting an inaugural press conference under a new regime for communicating policy, said that the outlook is “consistent” with the need for higher borrowing costs -- but only in due course.

'The exact timing of the first move cannot be predicted in advance,' he told journalists in London on Thursday. 'It will be the product of economic developments and prospects. In short, it will be data dependent.'

The 8-1 decision by the Monetary Policy Committee to keep the benchmark rate at a record-low 0.5 percent "That from Bloomberg. Because the situation in the UK looks a bit like the US (low inflation in an uncertain -- but accelerating -- economy), it is not unreasonable to think that Janet Yellen may also take the "wait and see" route. Carney's language "in short, it will be data dependent" could easily be attributed to Fed Speak.

Central bankers still have no clear policy response to periods of low unemployment and low inflation. Laurence Meyer’s A Term at the Fed depicts the situation in the 1990s. While the “doves” wanted to keep rates low due to low inflation despite a surging economy, the “hawks” advocated raising rates in expectation of future inflation.

As I said a few days ago, the likelihood that the Fed will raise rates in September is probably much lower than polls would suggest.

The immediate turn around in inflation from the Bank of England forecast feels pretty shady -- I foresee lower-than-expected inflation to persist for quite some time. (It also appears unrealistic that their most likely inflation projection has symmetric upside and downside risk.)

No comments:

Post a Comment